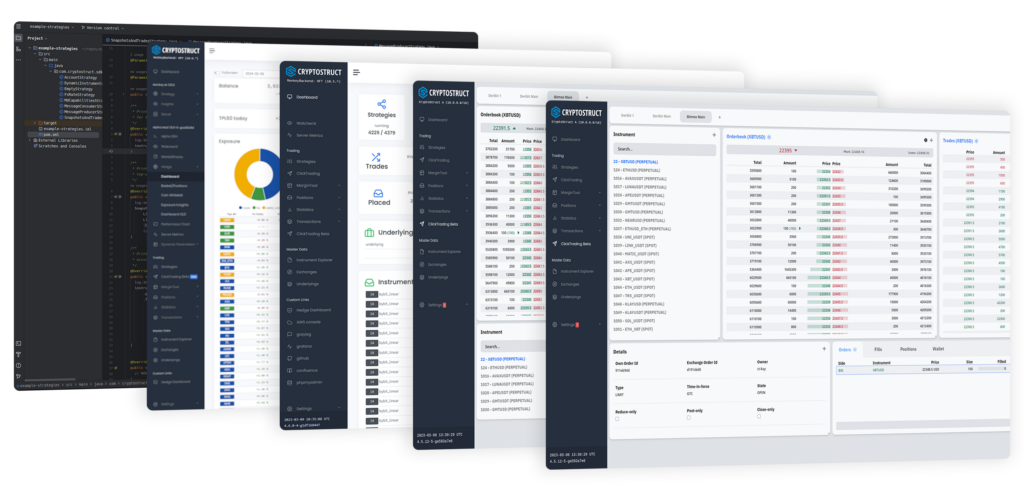

Analyze. Connect. Trade.

Industry-Leading Low-Latency Solutions for Algorithmic and High-Frequency Trading

CryptoStruct delivers professional-grade software solutions for algorithmic traders and market makers, proven in the most demanding production environments worldwide. Our platform provides fully normalized, ultra-low-latency market data, an advanced strategy framework, and a scalable trading engine capable of executing strategies with microsecond precision across virtually the entire global crypto market.

Free Trial Available!

Experience industry-leading performance with zero risk.

Our Solutions

Ultra-Low-Latency Trading Engine

Our event-driven, high-performance trading runtime with integrated risk management delivers deterministic microsecond latency even under extreme loads. Engineered to process billions orders per day, it can execute thousands of strategies in parallel without performance degradation. Its redundant architecture ensures continuous, fail-safe operation, providing the reliability demanded by the most sophisticated trading environments.

Additional Features

- Sophisticated backtesting capabilities

- Trading analytic tools

- Latency monitoring

- Secure setup (cloud or on-premises) ensures exclusive access to your trading environment

Normalized, Co-Located Market Data

- Unified API across all connected exchanges

- Strategically co-located infrastructure for minimal latency

- Enhanced feed arbitrage to reduce jitter and exchange-induced delays

Market Statistics & Analytics

- Turnover, spreads, OTR, OHLC, VWAP, maker/taker opportunities, latencies, and more

- Available in real time and historically

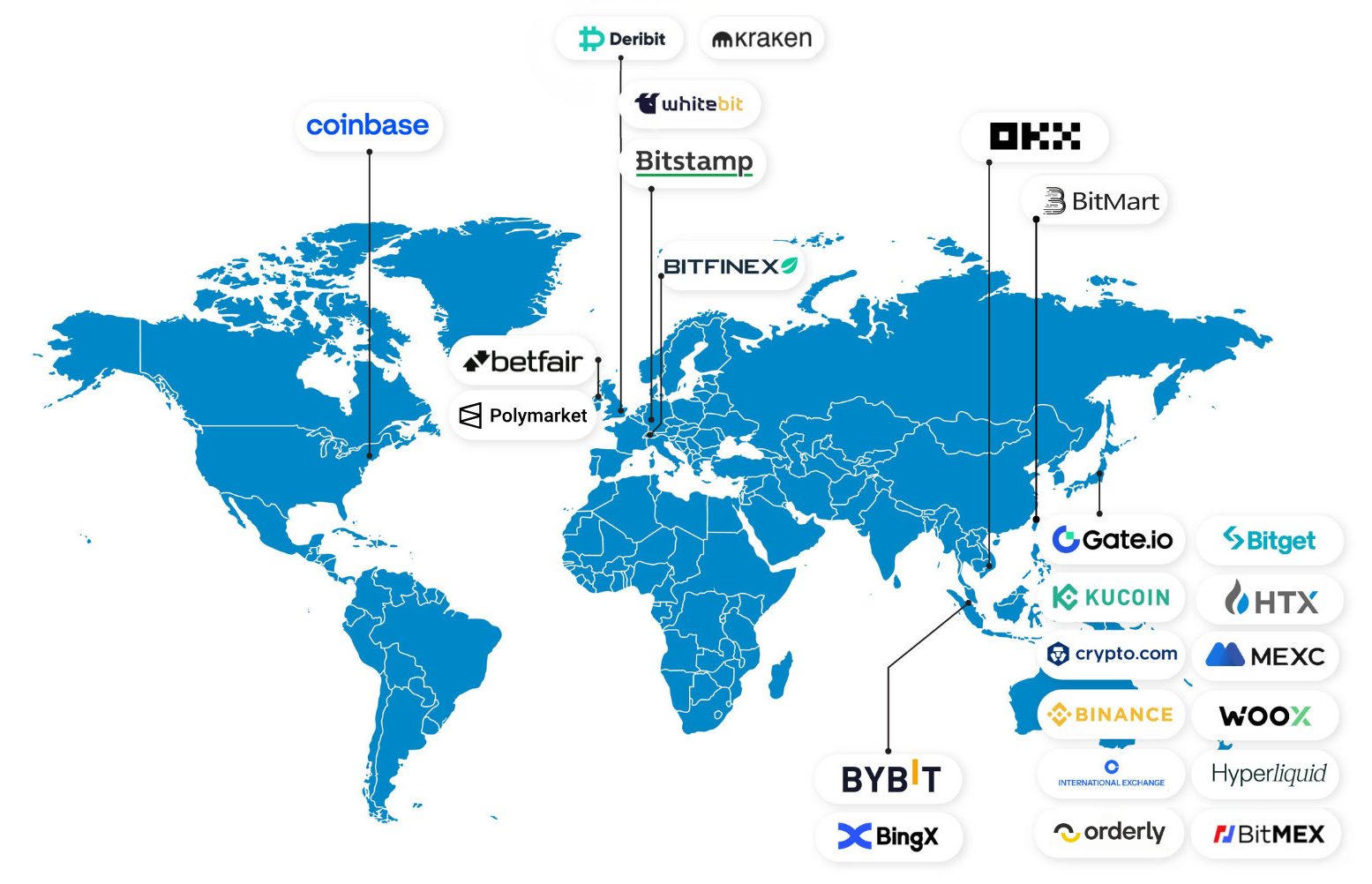

Exchange Coverage

Why CryptoStruct?

Built by Market Leaders – Chosen by Market Leaders

Developed by industry veterans with decades of high-frequency trading and market-making expertise, proven in production at one of Europe’s top proprietary trading firms, and part of the SSW Group – a European leader in algorithmic proprietary trading.

Unmatched Scalability

Infrastructure engineered to handle billions of daily orders with seamless support for thousands of instruments simultaneously.

Global Reach & Co-Location Advantage

Cloud and data center infrastructure positioned directly alongside exchange systems, often with specialized connectivity, ensuring minimal latency and optimal market access.

Proven Reliability

Stress-tested under live market conditions and delivering years of stable operation in mission-critical trading environments.